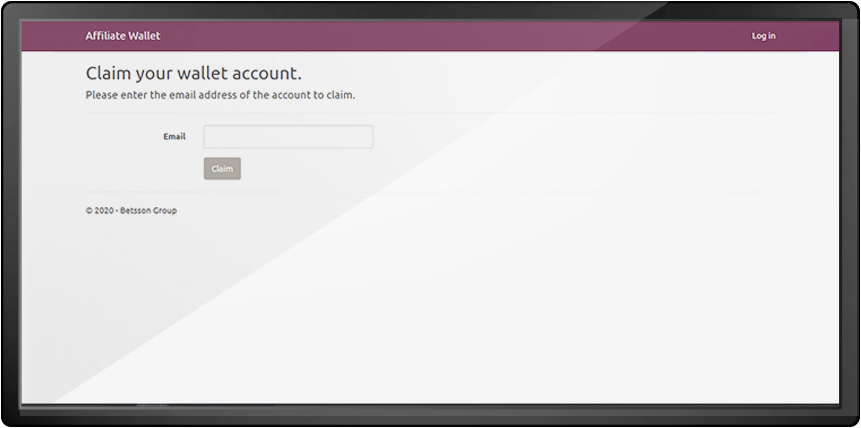

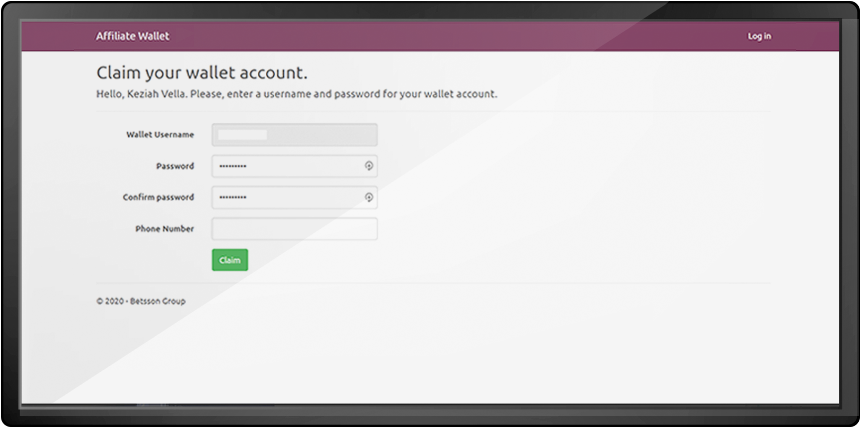

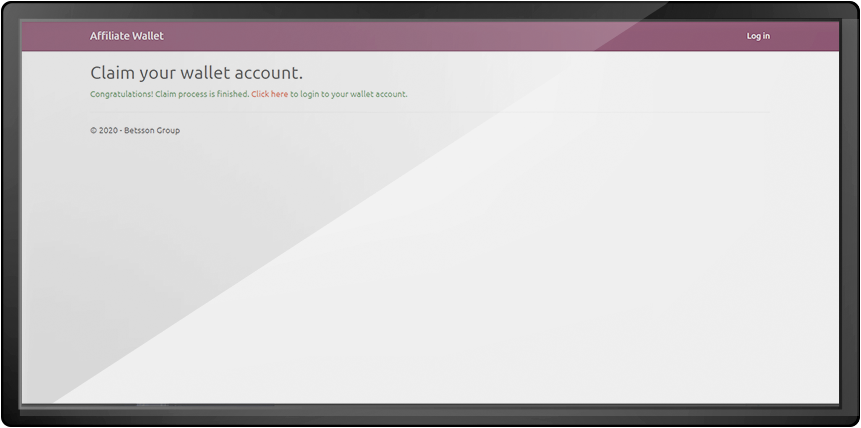

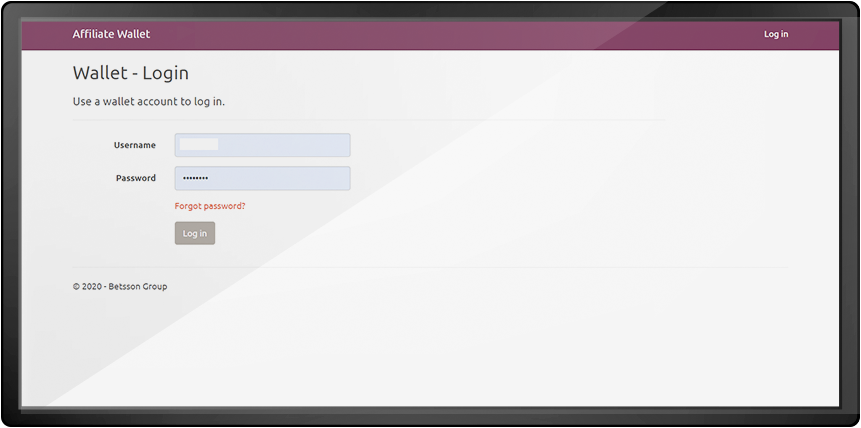

How to claim your wallet

Get access to your exclusive wallet within a few hours after your account is approved. Claiming your wallet is fast and easy!

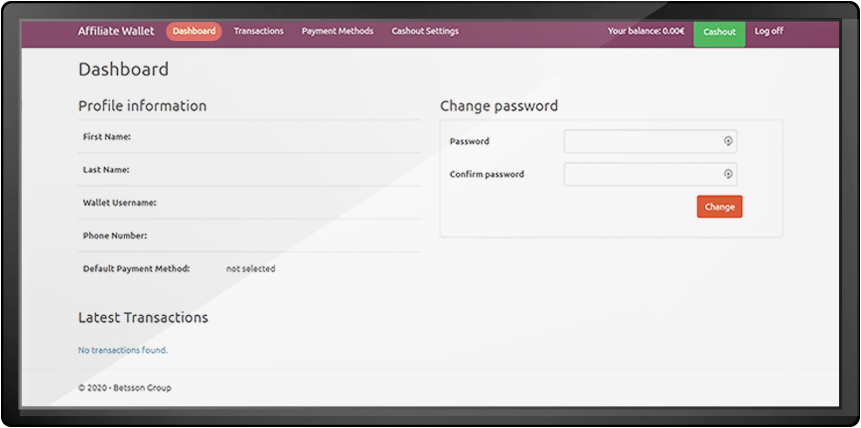

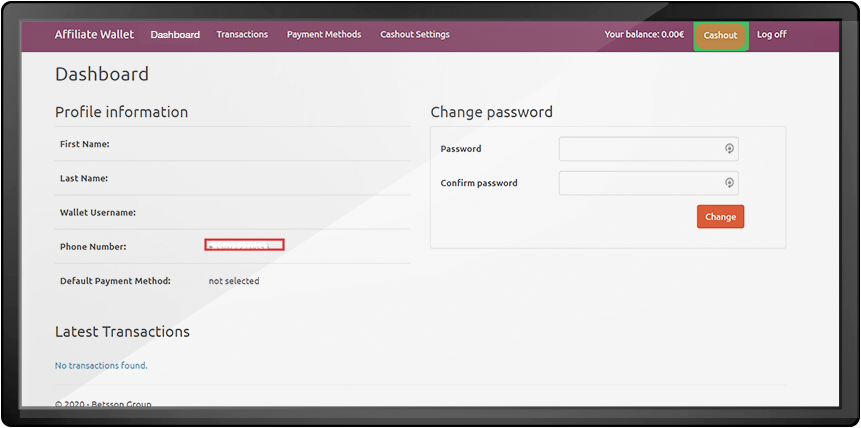

Using your Wallet

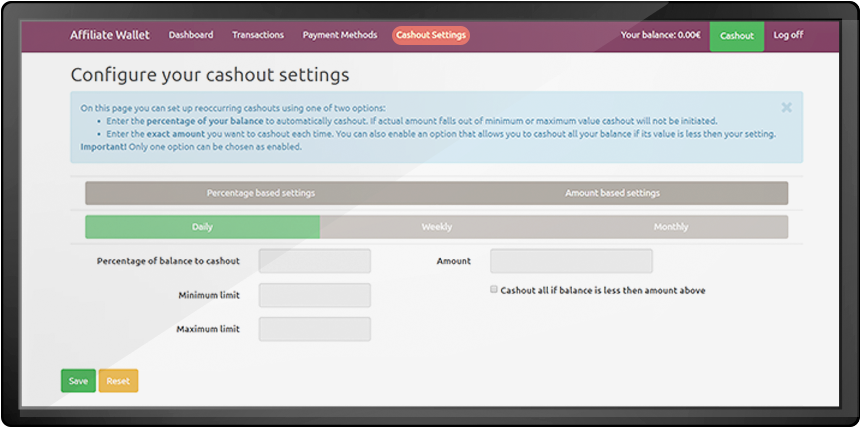

Payout Date:

Earnings will be available for withdrawals in the Affiliate Wallet by the 10th of the following month.

Minimum Payout:

A €50 minimum payout is applied, whereby if the value is less than the €50 threshold, it will be carried forward to the next month and paid out to the Wallet once the balance is more than €50.

VAT Taxable Maltese Companies:

If you are a Maltese company and need to be reimbursed VAT, you need to forward a copy of your VAT Certificate to your Account Manager or support@betssongroupaffiliates.com so that your Wallet account is set to taxable at 18%.

Once the account is set as taxable, affiliates will be in a position to upload VAT invoices.

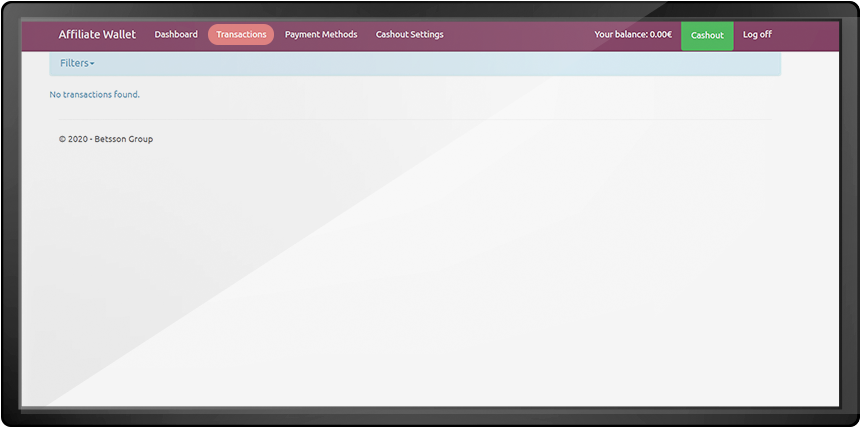

Partners will then be in a position to upload VAT invoices in the Affiliate Wallet by going on the ‘Transactions’ tab.

A ‘RED’ button will appear, and you will then be in a position to upload your tax receipt. The upload button will always be there for taxable customers.

It is important to multi-select the transactions in question and upload one invoice for the matching transaction/s plus the VAT amount.

Before posting the invoice, one will be prompted with a summary of the calculations, which includes the reference/s of the payments, the amount of the original payment/s, the corresponding VAT which is automatically calculated and the total due.

Past invoices can also be uploaded as long as the date reads the current year.

Once the month is closed, at the end of every month, VAT will be reimbursed accordingly.

Invoice details:

Betsson Services Limited

199, Experience Centre

Ta’ Xbiex Seafront

Ta’ Xbiex

XBX 1027, Malta

VAT: MT 1885-2233

Registration No: C44114

Please note that the Betsson Group Affiliates Wallet is solely dedicated for fund transfers of approved commission earnings for affiliated players on the Betsson Group Affiliates brands. No other funds or transactions will be reported, held or transferred through this Wallet.

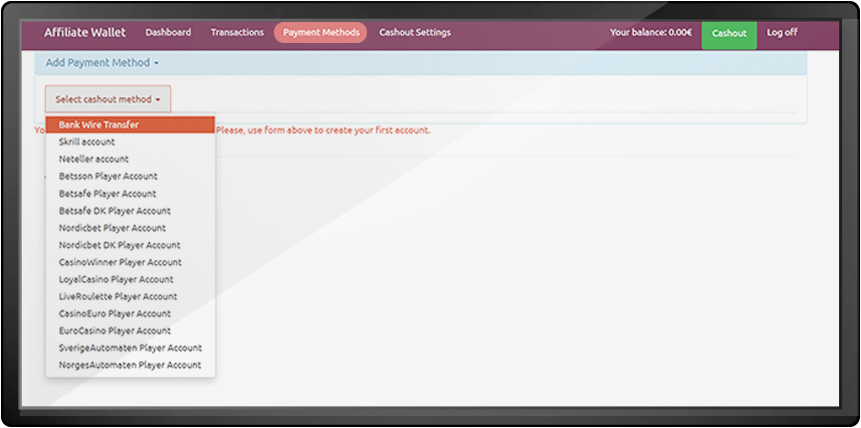

Payment Methods Information:

For further information relating to which countries cannot use a specific payment method, kindly click on the following links;

- Neteller

- Skrill

- Envoy (Bank Wire) (Affiliate payments to Norway (in either EUR or NOK) is not permitted as it is a gambling restriction)

*Note: these countries cannot receive gambling related commissions/payments:

- France

- Singapore

- Israel

- Hungary

**Note: these countries cannot cash out directly from the Affiliate Wallet but would have to get in touch with us in order to proceed with pay-outs:

- Colombia

- Argentina

- Brazil

If you require more information, please contact support@betssongroupaffiliates.com.